BlackRock CEO Troubles Stark Fed Warning Amid $3.3 Trillion Bitcoin Price Prediction

Bitcoin and crypto prices have surged in the past week, helped by growing expectations of a major crackdown in China.

Unlock over $3,000 in benefits including unparalleled access to a community of top Web3 entrepreneurs, innovators and investors, giving you top networking, early access to world events, free access to Forbes.com and ours Forbes CryptoAsset & Blockchain Advisor newsletter. Apply now!

The price of bitcoin touched its all-time low of $74,000 per bitcoin when Tesla billionaire Elon Musk announced a “financial emergency” that some think will send the price of bitcoin even higher.

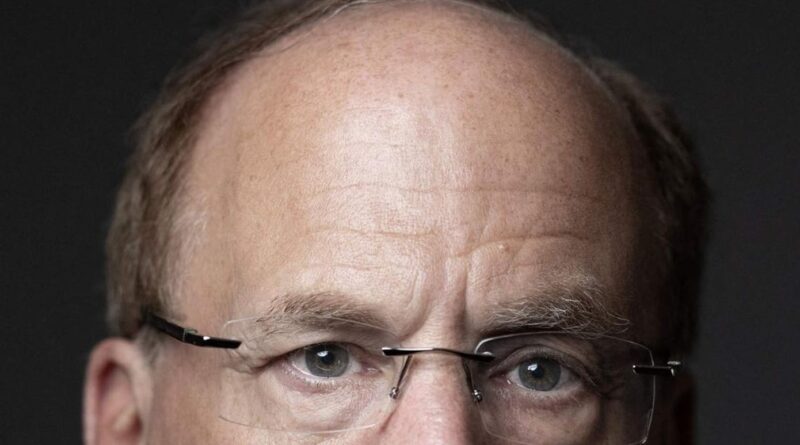

Now, with the Federal Reserve facing a “frustrating” situation, Larry Fink, chief executive of the world’s largest asset manager BlackRock, has warned that he doesn’t think the Fed will cut rates as fast as expected by the markets.

Sign up now for free CryptoCodex–A daily five-minute newsletter for traders, investors and the crypto-curious that will update you and keep you ahead of the curve on bitcoin and crypto market.

BlackRock CEO Larry Fink has embraced bitcoin and crypto this year, helping bitcoin … [+]

“We’re not going to see interest rates as low as people are predicting,” Fink, who oversees BlackRock’s $10 trillion in assets, said during the conference call. Bloomberg The panel was part of Saudi Arabia’s annual investment conference, the Future Investment Initiative.

Fink predicted the Fed’s only one interest rate cut before 2025 against market expectations of two.

“I think it’s fair to say we’re going to have at least 25 (cuts in the fundamentals), but, that being said, I believe we have more inflation in the world than we’ve ever seen,” Fink. warned.

Last month, the Fed surprised investors with a 50 basis point cut in interest rates, kicking off a cycle of cuts after interest rates were raised to a record high as lockdown-induced inflation threatened to spiral out of control. .

Expectations that interest rates will drop significantly this year have fueled the rise in bitcoin prices until 2024, as bitcoin and the broader crypto market lag behind stock markets.

High interest rates have raised payments on the debt pile of 35 billion US dollars, while Tesla billionaire Elon Musk last week warned “interest payments on the debt are 23% of the total income tax” and announced the situation “financial emergency.”

Sign up now for CryptoCodex-Free daily newsletter for crypto enthusiasts

The price of bitcoin has reached an all-time high of around $73,000 per bitcoin, helped by the … [+]

Meanwhile, SkyBridge Capital founder Anthony Scaramucci has predicted that the Fed will allow inflation to run hotter than ever to avoid a “severe debt crisis” – thanks to rising bitcoin prices. .

“There are a lot of people who think that the US is about to get into this big debt crisis. And I believe that we will solve … that and we will prevent that from happening,” Scaramucci he told Reuters World Markets Forum.

Scaramucci said he expects the price of bitcoin to hit $170,000 by the middle of 2026, which would give bitcoin a market capitalization of about $3.3 trillion, due to “a limited stable supply, and that is think it’s a very high demand.”

That demand has been reinforced this year by the long-awaited arrival of a group of bitcoin exchange-traded funds (ETFs) on Wall Street, led by the BlackRock fund.

On Wednesday, BlackRock’s bitcoin ETF saw inflows of $872 million, marking the fund’s biggest inflow since its launch in January and surpassing the previous record set on March 12.

“The recent increase in BlackRock’s IBIT inflows was driven by a number of key factors, including a global shift by central banks towards cutting interest rates, which increased liquidity and make money available to investors,” said Rachael Lucas, crypto analyst at BTCMarkets. The Block.

#BlackRock #CEO #Troubles #Stark #Fed #Warning #Trillion #Bitcoin #Price #Prediction